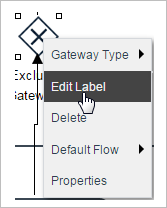

From serving in the card features to expenditure ultimately drifting into the trader’s bank account and resolve, the expenditure gateway approves through a various number of steps. The first step is that after the consumer spots the respective order online and proceeds to bring about payment for the similar, and also customers need to provide details about the credit card and debit card. The next step is that card circumstances are entered and encrypted safely with SSL which is known as Secure Socket Layer, encryption to be transmitted between the online browser and the trader’s website server, and also free white label payment gateway provides various services. This obedience responsibility is without changing course consumers out from the website. After this, the trader broadcasts marketing circumstances to their expenditure gateway, this method is also the SSL encrypted alliance to the expenditure server or website hosted by the expenditure gateway. And then communicates the marketing data to the expenditure processor utilized by the dealer’s obtaining bank. The expenditure processing method transmits the marketing data to the debit card or credit card association. Following, the bank credit card granting bank obtains the permission proposal, ascertains the credit card or debit card usable, and then carries an acknowledgment heretofore to the processor through the procedure similar as for the approval with an acknowledgment code that is authorized or rejected. The acknowledgment code furthermore enables to convey the explanation for the issue of a declined transaction, for instance, insufficient money, card expired, and so on. The processor again communicates the approval acknowledgment to the expenditure gateway, and the expenditure gateway obtains the acknowledgment and delivers it to the interface utilized to function the payment. This procedure is named Authorization or else “Auth”. This completely takes around two to three seconds in common. The following step is that the trader then satisfies the respective order and the above following step-by-step process would be narrated but this period to “Clear” the approval by consummating the trade. Commonly, the “Clear” is commenced merely after the trader has completed the marketing that is shipped the respective order. This conclusion in the handing out bank ‘clearing’ or ‘auth’ that is shifting the auth-hold towards the debit and instructs them to resolve with the trader obtaining bank. Then the trader accepts all their correct consents, in a “batch” at the end of the day to obtain bank details for payment through its processor. This commonly lessens or “Clears” the related “Auth” if they have not been explicitly stated, “Cleared.” Then the expanding bank gives rise to the batch payment proposal of the respective credit card provider. The credit card provider gives rise to a compromise payment to the amassing bank the successive day in maximum cases. The accumulating bank thereafter residues the whole of the authorized budgets into the dealer’s nominated bank account the exact day or else the following day. This would be an explanation with the expanding bank if the dealer performs their banking with the exact bank or respective bank account with another bank. Eternally since demonetization blew the economy, digital expenditures have fulfilled the most select forum of giving rise to marketings for the abundances.